Bank of East Asia will change its corporate colour and slogan starting today, the first time in a decade that Hong Kong’s oldest family-run bank is refreshing its looks, as it sharpens its focus to serve wealthy customers in the city and on the mainland.

The bank’s red-and-white logo – in use since 2002 – will change to a Solar colour scheme redolent of a dawning sky with a yellow-to-orange gradient. Its slogan exhorts customers to “Live every moment”, a more dynamic take after the global Covid-19 pandemic than the “Enriching your world” tagline used since 2013.

“The new corporate colour and slogan remind our customers that Bank of East Asia can provide all types of wealth management services for their financial well-being,” said co-chief executive Adrian Li Man-kiu, a fourth-generation scion of the family that has controlled the bank since it formally opened for business in 1919. “When we take care of our customers’ wealth and financial planning, they are in a better position to take care of their health and lives.”

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

The new look will be rolled out in phases across more than 100 branches and outlets in Hong Kong and on the mainland, the bank said. Like its competitors HSBC and Standard Chartered, Bank of East Asia is betting on Hong Kong’s expanded role in the Greater Bay Area to tap the growing affluence and potential for wealth management in southern China.

Hong Kong’s Chief Executive John Lee Ka-chiu has a very specific goal to attract 200 family offices to set up in Hong Kong by 2025, adding to the estimated 400 that are already managing the fortunes of their wealthy principals out of the city. These offices also engage in succession planning and philanthropy.

The timing is right to refresh the brand, said co-CEO Brian Li Man-bun, the younger son of the bank’s executive chairman David Li Kwok-po. The bank, headquartered on Des Voeux Road Central throughout its century-long history, is poised to move about 300 employees into its 18-story BEA Tower at the Qianhai financial area in Shenzhen when it opens on January 12.

“The BEA Tower in Qianhai will be the headquarters of BEA in southern China as a mark of our commitment to invest in the Greater Bay Area,” said the younger Li, adding that the bank will use half of the building for its banking and wealth management businesses, and lease the remaining space. “Many clients live and have business on the mainland and in Hong Kong, and we want to provide a one-stop banking [solution] for them.”

The bank operates 48 branches in Hong Kong, and manages 63 outlets across 38 mainland cities including 20 in the Greater Bay Area. Its worldwide network includes Singapore, Malaysia, the United States and the UK.

Wealth management is a focus for the bank, as new accounts and assets under management both grew by double-digit percentages in the first 10 months of the year. New accounts increased by 50 per cent in the third quarter, compared with three months earlier, the bank said.

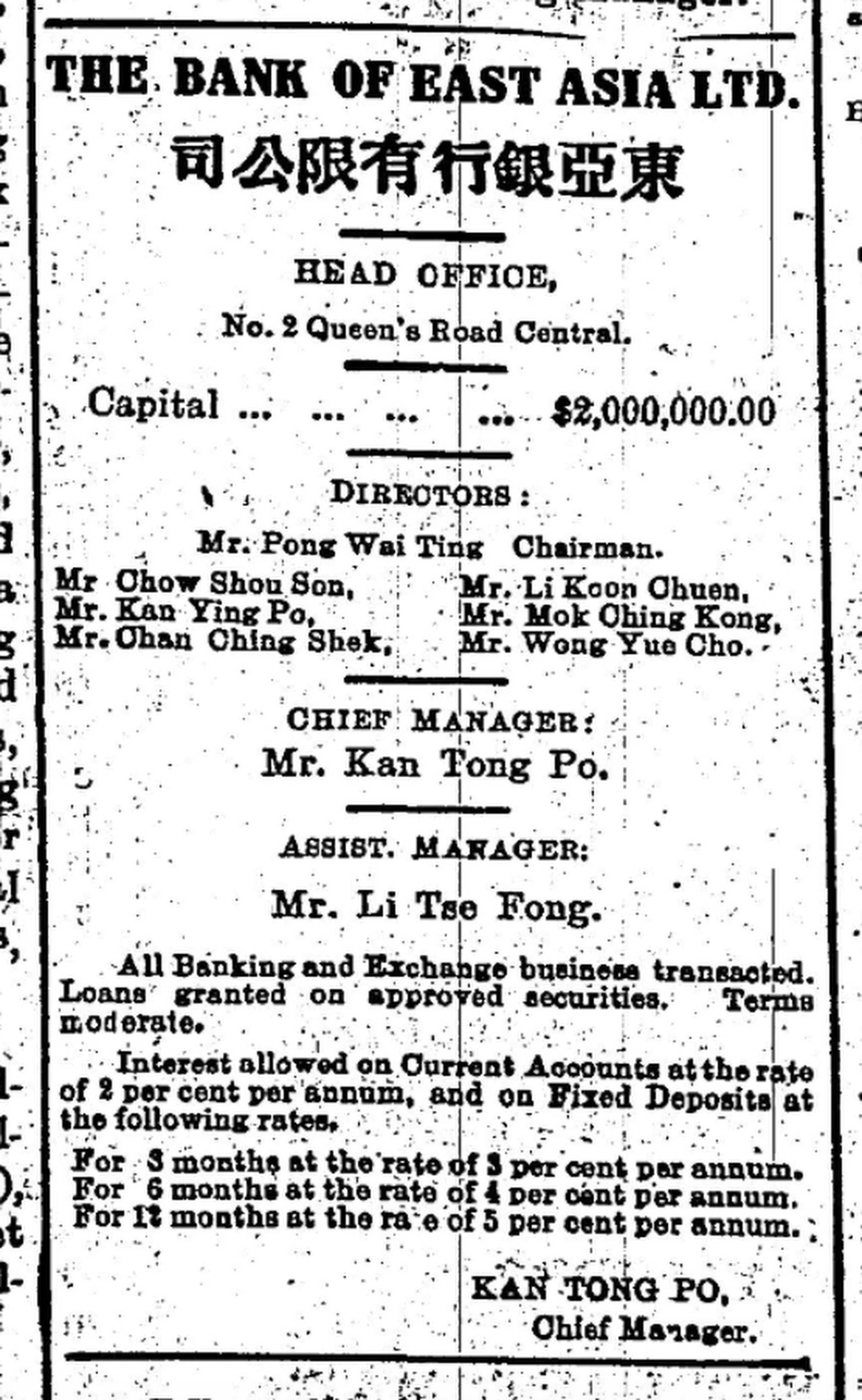

The bank was co-founded by the brothers’ great-grandfather Li Koon-chun, great-uncle Li Tse-fong and seven others on November 14, 1918, just three days after the First World War ended. The bank formally opened for business in January 1919. The brothers’ father David joined the bank in 1969 and was its chief executive for nearly four decades from 1981 to 2019. The senior Li handed the reins to his two sons in 2019 as co-executives.

Before Bank of East Asia changed its emblem in 2002 to resemble a globe, its logo featured the likeness of a Chinese coin.

“The redrawn globe emphasises BEA’s successful history, along with its regional and worldwide reach and the scale of its operations,” Adrian Li said.

Fintech, and loans for environment, social and governance-related businesses will be the growth engine for the bank’s future, he said. The bank will also continue to look at overseas opportunities, including Southeast Asia and the Middle East, he added.

Some 84 per cent of its young customers are active digital banking users, while 62 per cent of its private banking and prestige banking customers like to use online banking services. Overall, 86 per cent of all BEA financial transactions now are through unstaffed channels such as automated teller machines, or online banking.

More from South China Morning Post:

- Hong Kong’s wooing of family offices yields ‘robust’ interest from Southeast Asia, Middle East: top Citi banker

- Bank of East Asia, China Construction Bank earnings marred by rise in bad loans to mainland’s distressed property sector

- BEA’s new US$209 million southern China headquarters in Qianhai to serve as gateway to Greater Bay Area expansion, co-CEO Adrian Li says

- Bank of East Asia to ride on AIA dominance in China after divesting insurance assets in partial victory for Paul Singer’s hedge fund

- Bank of East Asia appoints retail loans chief to lead Greater Bay Area office to drive cross-border wealth management business

For the latest news from the South China Morning Post download our mobile app. Copyright 2023.