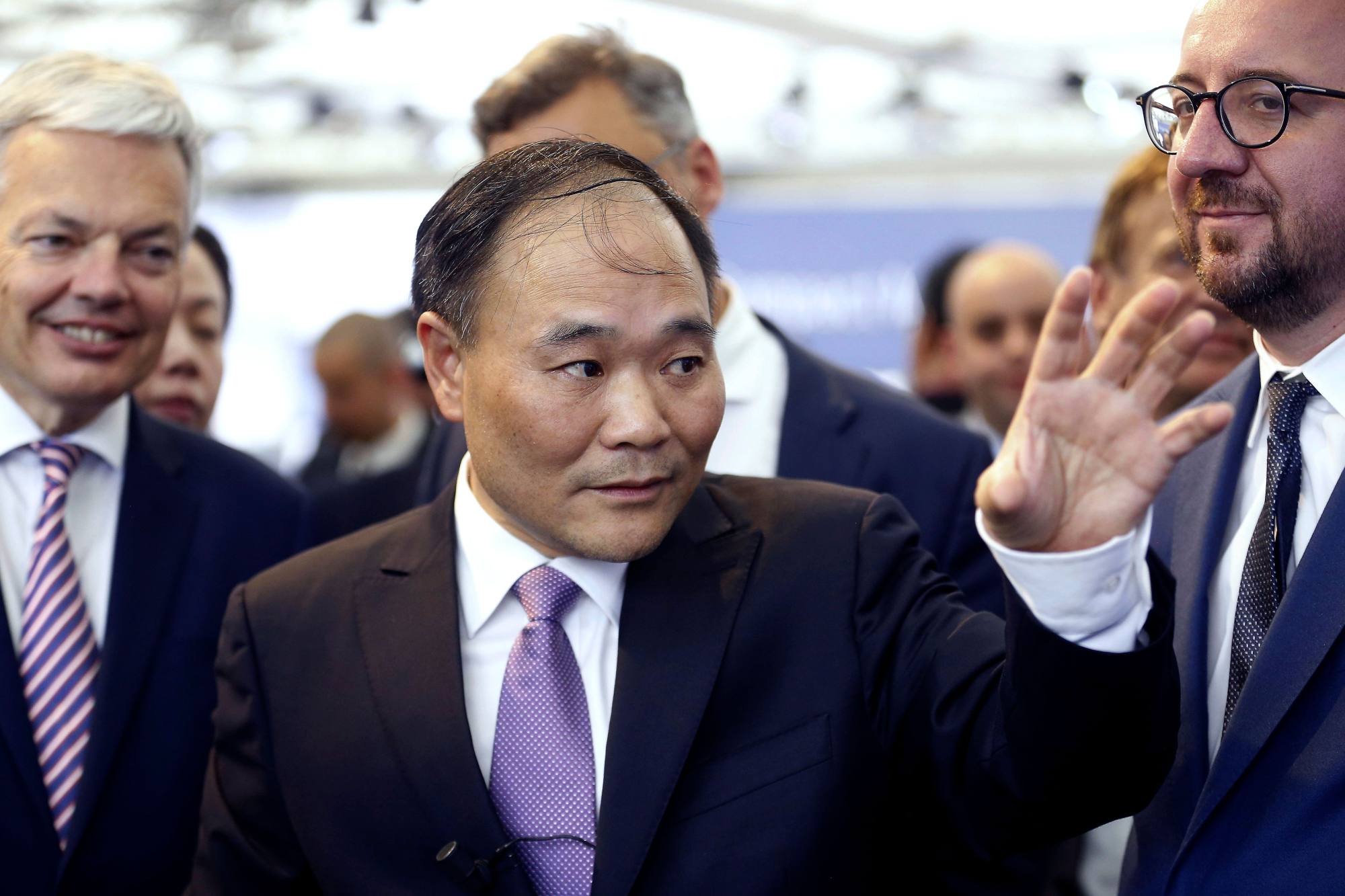

Li Shufu, the billionaire who controls one of China’s biggest electric vehicle (EV) makers, is consolidating his business under his Hong Kong-listed flagship Geely Auto. He and his associates will extract more than US$2 billion by selling their stakes in the process.

Geely Auto has agreed to buy an 11.3 per cent stake in New York-listed Zeekr Intelligent Technology for US$806.1 million or US$26.87 per share, according to a stock exchange filing on Thursday. The purchase will raise its stake to 62.8 per cent. The seller is a company ultimately owned by Li and his associates.

Separately, Zeekr said it will buy a 50 per cent stake in car maker Lynk & Co for 9 billion yuan (US$1.24 billion) from two entities related to the tycoon. It will also buy additional new shares in Lynk to raise its stake to 51 per cent, diluting Geely Auto’s stake to 49 per cent.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

Zeekr, which got listed via a stock offering in May, sank 23.68 per cent to US$22.24 in New York trading after the announcement. Lynk, which is unlisted, produces both electric and petrol-powered cars. Both remained unprofitable, according to their most-recent financial reports.

“Zeekr and Lynk bear similarities in product line-up and price ranges, which will inevitably lead to [unnecessary] competition, internal conflicts and waste of capital if they are not integrated,” Gui Shengyue, CEO of Geely Auto said during an earnings call on Thursday. “Cross-competition between the two brands hinders Geely’s development.”

The Zeekr acquisition shows the group’s support for the brand, Geely Auto said in its filing. It will simplify Zeekr’s shareholding structure, enhance the group’s influence over its business direction and facilitate allocation of strategic resources and future plans, it added.

Li is reorganising his Hangzhou, Zhejiang-based empire amid excess capacity in the industry and a cutthroat price war among domestic EV producers. Efforts to expand overseas have been met with punitive tariffs on China-made EVs in the US and Europe. Donald Trump’s US election victory has cranked up pressure on Chinese exports.

The asset reshuffling is an early sign of an industry overhaul to deal with those challenges, analysts said.

“Cost control is the name of the game in China’s EV industry, now that nearly all the players are unprofitable and have to survive fiercer competition,” said He Yan, a fund manager with Shanghai Shiva Investment. “I believe business integration and consolidation will be widely pursued among Chinese carmakers.”

Meanwhile, Geely Auto said its third quarter earnings surged 92 per cent to 2.46 billion yuan from a year earlier, while revenue climbed 20 per cent to 60.4 billion yuan. Zeekr’s net loss for the three months to September 30 narrowed by 22 per cent to 1.14 billion yuan.

Geely said it envisioned creating a premium EV powerhouse with annual deliveries of more than 1 million units following the internal reorganisation. The two brands delivered a combined 339,000 EVs to customers last year.

To date, only the world’s largest EV builder BYD and Tesla’s nearest rival Li Auto are profitable EV makers among the 50 or so producers in mainland China.

Nick Lai, an analyst with JPMorgan Chase, said early this year that some of the EV brands in China, the world’s largest automotive and electric car market, will either be edged out or be taken over by their larger rivals.

Zeekr is among China’s fastest-growing EV brands this year, buoyed by its high-performance battery and Geely’s manufacturing heft. It delivered a record 55,003 units in the third quarter, up 51 per cent from a year earlier.

Lynk was set up in 2016 as Geely tapped Volvo’s design capability to churn out premium vehicles amid the group’s ambitions of turning itself into a world-class carmaking giant.

More from South China Morning Post:

- China EVs: Geely’s Zeekr launches MPV aimed at middle-income households

- SAIC Motor, Geely deny breaking ranks in China’s bargaining with Europe on EV tariffs

- Geely discounts its Zeekr 7X by another 4% as deliveries start, adding pressure on Model Y

- China’s EV king BYD and 3 rivals report record sales as domestic market hums

For the latest news from the South China Morning Post download our mobile app. Copyright 2024.