As Chinese President Xi Jinping inaugurated the US$3.5 billion Chancay port in Peru this month that promises to jump-start exports in the region and create a gateway to China, US Secretary of State Antony Blinken oversaw a ceremony just a few miles away to give US$6 million in 1980s diesel locomotives to the Andean nation.

The split screen said it all. One was about the future, the other about the past.

“Delivering used locomotives, that’s a good thing,” said Eric Farnsworth, vice-president of the Americas Society and Council of the Americas. “But if you land side by side with a multibillion-dollar state-of-the-art port that will redefine trade between the region and China, it comes up a poor second.”

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

While the growing gap between Chinese and US investment, focus and attention in South America has been evident among analysts, this everyday example hit home for experts and laymen alike.

“It solidified in the minds of the casual observer what the reality is,” added Farnsworth, formerly with the US State Department and the office of the US Trade Representative. “That is the lasting impression that’s going to carry forward for the foreseeable future.”

Xi’s departure last week after a state visit with Brazilian President Luiz Inacio Lula da Silva in Brasilia ended a nine-day swing through South America, an economic and diplomatic victory lap through the “backyard” of China’s chief adversary, the United States.

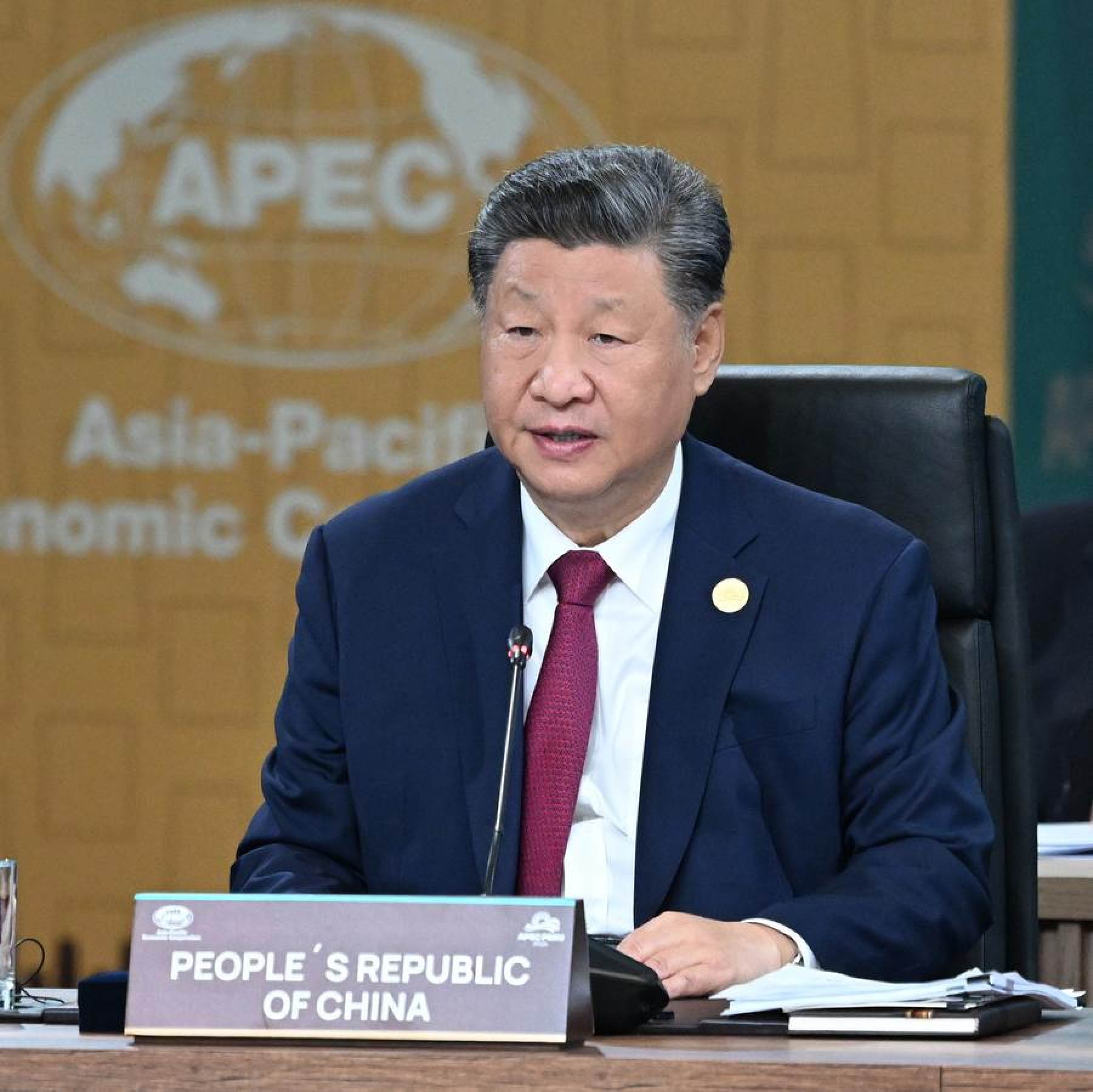

In addition to the port opening, Xi delivered sharp remarks both during the Asia-Pacific Economic Cooperation summit in Lima and when meeting US President Joe Biden on its sidelines, promoting China’s commitment to regional development, globalisation and trade liberalisation.

This comes as the US prepares – and the world braces – for inward-looking “America first” Donald Trump to return to the White House, with Beijing happy to step into the vacuum left by Washington’s eroding footprint.

Seeding the ground for future dividends, Xi also signed dozens of bilateral trade agreements with Brazil, upgraded China’s free trade agreement with Peru and fielded some 400 business leaders in his slipstream ready to do deals.

By contrast, Biden, a lame duck with two months remaining in his term, left few shadows, largely avoided the press, missed a ceremonial photo with G20 leaders that had to be rescheduled and waited until the final days of his administration to visit the region as president.

Biden’s decision to decline an invitation by Lula for a state visit, meanwhile, reportedly cleared the way for Xi to grab the spotlight in Brasilia.

“This was a big overall win for Xi and China,” said Cynthia Sanborn, director of the Centre for China and Asia-Pacific Studies at the Universidad del Pacífico in Lima. “It didn’t seem like the US president was really here at all.”

Rather than offer South America a US alternative to Chinese programmes, some in Washington – particularly those close to the incoming Trump administration – have focused more on badmouthing or undercutting them.

As China opened the Chancay port with great fanfare, Trump transition adviser Mauricio Claver-Carone, a White House senior director for the Western hemisphere in Trump’s first term, called for 60 per cent import tariffs on all goods passing over its docks, mirroring the high import taxes Trump has threatened on all goods from China.

“At least he didn’t recommend sinking the ships in the harbour. In terms of a solution, this is going in the wrong direction,” Farnsworth noted wryly.

One problem: the China-funded port project, which saw US$1.3 billion invested in 2019 out of the total expected cost of US$3.5 billion, has little to do with shipments to or from the US.

“It’s irrelevant, the goods are going directly to China,” said Jorge Heine, Chile’s former ambassador to Beijing. “The pettiness. This didn’t go down well in the region.

“And it underscores the success of Peru’s strategy toward the Asia-Pacific. This is the third time it’s hosted Apec, and China has become its No 1 trading partner.”

For countries with struggling economies in need of development help, the implicit and explicit US message that they should eschew what China is offering out of some sort of historical loyalty does not always play well.

A recent case has been the arm-twisting to reject use of Huawei Technologies’ 5G infrastructure, pointedly during the first Trump administration, but to a lesser extent during Biden’s term as well.

South American countries that need 5G technology can hardly be expected to accept US criticism – and happily stick with outdated 3G systems, Farnsworth said. “They need an alternative. That’s been the missing piece.”

Washington has traditionally considered Latin America part of its principal sphere of influence ever since the 1823 Monroe Doctrine – when James Monroe, the fifth US president, warned European powers not to meddle in the region.

For China, keen on expanding its global footprint, however, this is an outdated concept as it seeks resources and relations in a region where the US has had a chequered history of intervention. “Latin America belongs to its people,” the Chinese embassy in Washington said recently. “It is not any country’s ‘backyard’.”

That said, China’s regional profile is hardly unblemished. A hydroelectric dam project in Ecuador completed in 2016 has been beset by problems, including erosion and some 7,600 cracks that appeared in the turbines within the first two years.

Moreover, promised Chinese investment has failed to materialise. In 2015, Xi pledged US$250 billion in foreign direct investment to Latin America and Caribbean nations by 2019, a target that was never reached amid policy shifts and his protracted anti-corruption campaign.

And while two-way trade has grown rapidly, South American countries and much of the world face a sharp increase in Chinese imports as China’s economy swoons and its struggling companies turn to overseas markets to soak up their excess capacity.

In one example, Brazil recently raised tariffs on several Chinese exports including iron, steel and fibre optic cables.

South American governments have also complained that Chinese infrastructure projects still employ too much Chinese labour, limiting the transfer of expertise to the local economies.

Some analysts say China’s shortcomings must be put into context.

According to the World Bank, between 2000 and 2020, the GDP growth for Latin America and the Caribbean was 1.6 per cent – below every other region, including sub-Saharan Africa.

And for the decade ended in 2023, if fell to 0.9 per cent, significantly below the region’s 1.3 per cent growth during its “lost decade” of the 1980s.

Additionally, the region also suffers from a huge rich-poor gap, the lingering effect of weak foreign investment and the disproportionately high death rates incurred during the pandemic.

While Chinese investment has waned, even at reduced rates it has often filled gaps as US companies pull back, concerned in part by strict US anti-corruption laws and drawn to attractive opportunities elsewhere.

In a notable example, in 2021 Ford Motor abandoned a factory in the Brazilian state of Bahia after a century in South America’s largest market – only to see Chinese carmaker BYD acquire it and pour US$52 million into an upgrade.

“Some talk about this being the third lost decade” after the 1980s and 2013-2023, said Heine, now a professor at Boston University. “One of the few games in town is what China is putting on the table ... The real question is, does the US have something to offer instead?”

“What do you want?” he added. “The US is not coming through.”

Aware of China’s stronger hand, Xi spoke with a pugnacious and unapologetic tone at Apec and in talks with Biden on the sidelines as he defended globalisation and open trade. The message: even as the world braces for Trump, Biden’s “small yard, high fences” trade policies have not been much better.

“The world has entered a new period of turmoil and change, unilateralism and protectionism are spreading, the fragmentation of the world economy has intensified,” Xi told Asia-Pacific leaders in Lima.

“Hindering economic cooperation under various pretexts, insisting on isolating the interdependent world, is reversing the course of history.”

Xi’s statements during his trip also offered a glimpse into China’s planned economic and diplomatic responses to Washington’s changing of the guard, analysts said.

That includes countering US decoupling pressures by making inroads with the Global South. Beijing could also exploit policy differences between Washington and US allies Australia, Japan and South Korea in the Asia-Pacific while developing new markets for its exports and excess production.

“This is most apparent in Southeast Asia and Latin America but also applies to other regions,” said Jeremy Chan, a former US diplomat in China and Japan and now a senior analyst with the Eurasia Group. “Xi will focus on economic matters, where China has always found more success in attracting other countries and promoting China as a free-trade alternative to the US and a defender of the global order.”

Xi has waved the banner of free trade before, most notably in 2016 – also at an Apec summit in Peru – after Trump was first elected, then again a few months later in a high-profile speech in Davos. But that good will dissipated as China’s aggressive Wolf Warrior diplomacy, economic coercion and limited access to its own markets alienated other nations.

In 2016 and again in 2024, “it shocked me to have the leader of China, the leader of world’s largest communist party, declare that they would be the protector of free markets. It’s extraordinary chutzpah,” Farnsworth said.

“But what made that possible is the fact that the United States has meaningfully been withdrawing and creating a vacuum.

“I can’t blame China. They’re taking advantage. The question is, can we do better?”

More from South China Morning Post:

- Xi Jinping arrives in Peru for Apec, poised to sign 30 bilateral agreements for China

- Can another Xi-Biden summit move US-China ties under Trump 2.0?

- G20 summit begins with Brazilian host laying out ambitious global priorities

- Xi tells Biden he is ‘ready to work’ with Trump, but warns against US-China decoupling

For the latest news from the South China Morning Post download our mobile app. Copyright 2024.