BNM Governor Tan Sri Muhammad Ibrahim said: "Expansion was seen across all economic sectors."

KUALA LUMPUR: Malaysia’s economic growth continued to surprise on the upside, with the gross domestic product (GDP) expanding 6.2% in the third quarter of 2017, beating the median estimate of a 5.7% by 19 economists polled by Bloomberg.

Driven by robust private spending and continued strength in exports, the GDP growth pace for the three months to September was faster than the rate of 5.8% achieved in the second quarter of the year.

This higher growth was the fastest rate since second quarter 2014. On a quarter-on-quarter seasonally adjusted, GDP posted a growth of 1.8% against 1.3% in the preceding quarter, according to the Statistics Department.

"Expansion was seen across all economic sectors," Bank Negara Governor Tan Sri Muhammad Ibrahim said on Friday.

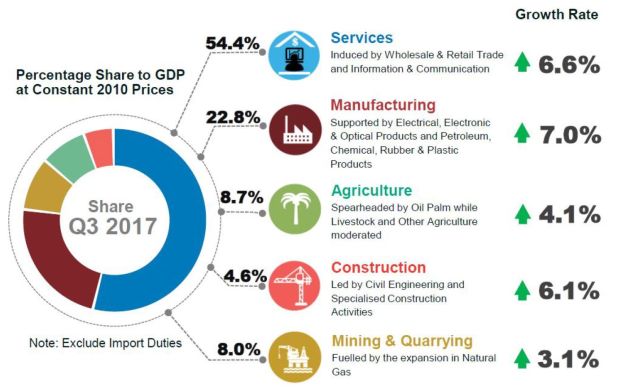

"On the demand side, growth was anchored by private sector spending. On the supply side, services and manufacturing sectors remained the key drivers of growth," he said at a briefing on Malaysia''s third quarter GDP review.

Muhammad said: "Looking ahead, the economy is poised to register strong growth in the upper end of the official target of 5.2%-5.7%."

In October, during the unveiling of the Budget 2018 proposals, the government revised upwards Malaysia's 2017 full-year GDP growth rate to the range of 5.2% to 5.7%, from its earlier estimate of 4.3% to 4.8%.

Last year, Malaysia’s GDP grew 4.2%.

Amid improving economic conditions in the country and globally, Bank Negara had last week said it might review its “accommodative” benchmark overnight policy rate (OPR) of 3%.

The central bank last raised the OPR, which commercial banks refer to in pricing their lending rates, in July 2014, when the benchmark rate was raised 25 basis points to 3.25%.

This was later slashed by 25 basis points to 3% in July last year to support domestic economic activities.

According to Statistics Department, the services sector rose to 6.6% after registering 6.3% in Q2 of 2017 – boosted by the wholesale & retail trade which remained strong by posting 7.5% in this quarter.

Information & communication improved to 8.8% fuelled by data communication, computer services and information services activities.

Finance & insurance grew to 4.2% as compared to 5.1% in the preceding quarter due to the moderation in the insurance sub-sector.

The manufacturing sector expanded at a faster pace of 7% from 6% in Q2, 2017.

Underpinning the growth was the electrical, electronic & optical products, which grew to 8.7%, supported by higher production of semiconductors, integrated circuit and communication equipment.

Petroleum, chemical, rubber & plastic products recorded a 5% increase, underpinned by a strong performance in refined petroleum product.

The agriculture sector grew at a slower pace of 4.1% after registering a growth of 5.9% in Q2, 2017. The growth for this sector was spearheaded by oil palm which remained resilient by recording a double-digit growth of 10% in this quarter.

However, livestock and other agriculture moderated to 4.5% and 1.5% respectively. Nevertheless, fishing rebounded to 0.3% supported by aquaculture which accelerated to 10.1%.

GDP by expenditure approach

Private final consumption expenditure expanded to 7.2% (Q2, 2017: 7.1%) mainly due to the consumption on food & non-alcoholic beverages, communication and housing & utilities.

Gross fixed capital formation (GFCF) saw a sharp increase to 6.7% (Q2, 2017: 4.1%). The strong growth in GFCF was driven by machinery & equipment which accelerated to 11.5% and recovery in other asset (7.2%) . On the other hand, structure posted a modest growth of 3.6%.

Exports surged to 11.8% from 9.6% in the previous quarter. The robust growth was reflected by stronger momentum in both exports of goods and services.

Imports increased 13.4% (Q2, 2017: 10.7%) following the improvement in imports of goods and services.

Get 30% off with our ads free Premium Plan!