Valued asset: On Tuesday, TM entered into a memorandum of understanding with TNB to look into ways on capitalising on the national power company’s fiber assets to help the Government deliver on the Nationwide Fiberisation Plan. — Reuters

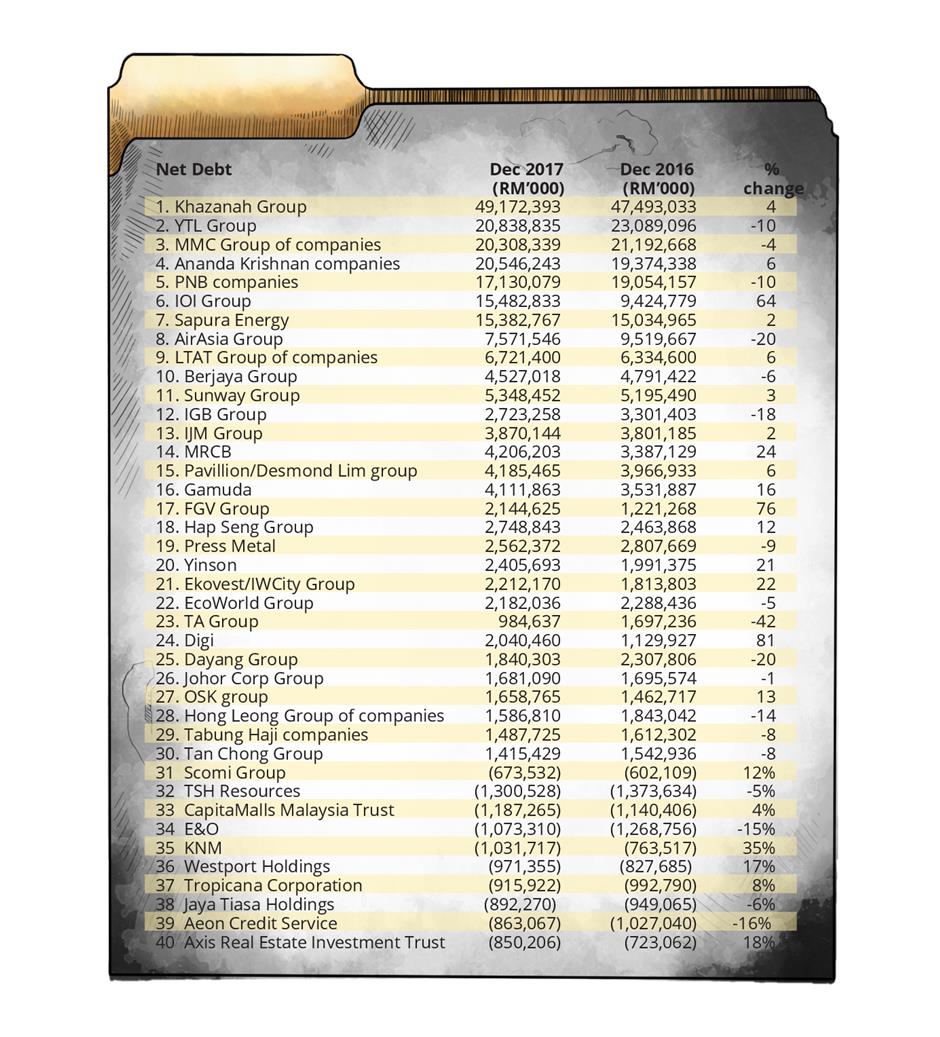

DEBT has always been an efficient tool for finance and investment and it comes to no surprise that the list of companies that have the largest amount of debt includes some of the largest companies on Bursa Malaysia.

Leading the pact is the stable of Khazanah Nasional Bhd companies. Companies that are controlled by Malaysia’s sovereign fund are monopolies and those that have invested in the infrastructure of the country.

Be it for energy generation and transmission to telecommunication services, these companies often have to fork out large sums of money to complete the infrastructure for such services and as a consequence, debt raising is an important part of funding such investments.

It is no surprise that Tenaga Nasional Bhd (TNB), among the companies controlled by Khazanah, has the most amount of debt at RM21.6bil given the expensive nature and demands for funding power stations.

(TNB), among the companies controlled by Khazanah, has the most amount of debt at RM21.6bil given the expensive nature and demands for funding power stations.

Among the Khazanah companies that had the biggest decline in debt is UEM Edgenta which saw its debt fall from RM4.5bil at the end of 2016 to RM1.4bil at the end of last year, aided by asset disposals that brought down its debt levels.

which saw its debt fall from RM4.5bil at the end of 2016 to RM1.4bil at the end of last year, aided by asset disposals that brought down its debt levels.

YTL Group is in the same segment as infrastructure companies.

The construction and infrastructure outfit has total net debt of RM20.8bil at the of last year from RM23.1bil the year before and much of the debt at YTL Corp is through their ownership of controlling stakes in other companies within the group.

Likewise for the MMC Group, it is the debt at power company Malakoff Bhd that has the biggest debt exposure.

With a net debt of RM12.2bil, Malakoff shoulders the bulk of the debt followed by MMC Corp, with its ownership of large ports, has debt amounting to RM8bil.

Pos Malaysia and Gas Malaysia are the two companies within the group with a net cash position.

Get 30% off with our ads free Premium Plan!