Touch

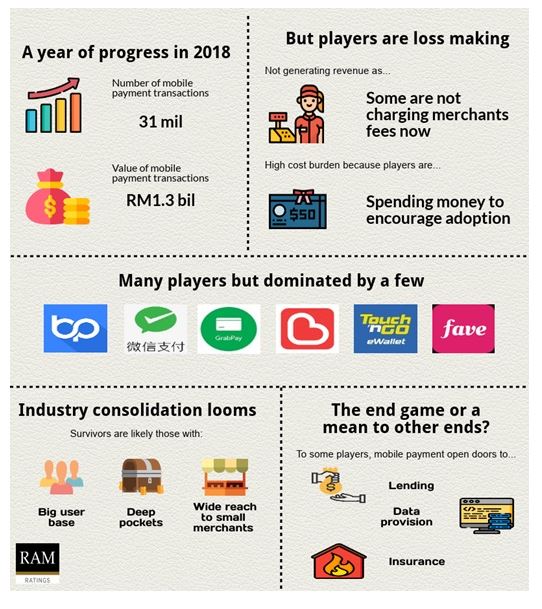

KUALA LUMPUR: RAM Rating sees a consolidation of mobile payments industry as most of the are still loss-making despite the increase in the number and value of payment transactions.

It said on Tuesday while this budding industry has 48 licence holders, only a handful dominate the field. Of these, almost all are owned or backed by high-profile businesses.

RAM Rating cited Touch ‘n Go eWallet, which is jointly-owned by CIMB and Ant Financial, while Boost is the mobile wallet established by Axiata Group.

Partnerships with banks are also common for many mobile payment players as they seek to expand their merchant bases.

“Nonetheless, most of them are still loss-making. Some do not charge merchants any payment processing fee at the outset in the interest of expanding and retaining their merchant bases. Moreover, many of them have to bear high operating expenses to promote adoption.

“Given all these developments, industry consolidation is very likely. The players that survive will likely be those with already substantive user and merchant bases, unique vale propositions as well as deep pockets to ride through the high levels of operating expenditure and tide of consolidation,” it said.

RAM Rating said with the aid of Bank Negara Malaysia, mobile payment players made headway in promoting this payment method.

The number and value of non-bank mobile payment transactions had risen to a respective 31.1 million and RM1.3 bil in 2018 (2017: 1 million and RM240.3 mil).

In its latest commentary, “Mobile payment in Malaysia – not a threat to Malaysian banks”, it said the increasing popularity of mobile payment in Malaysia is not considered a material threat to Malaysian banks.

Get 30% off with our ads free Premium Plan!