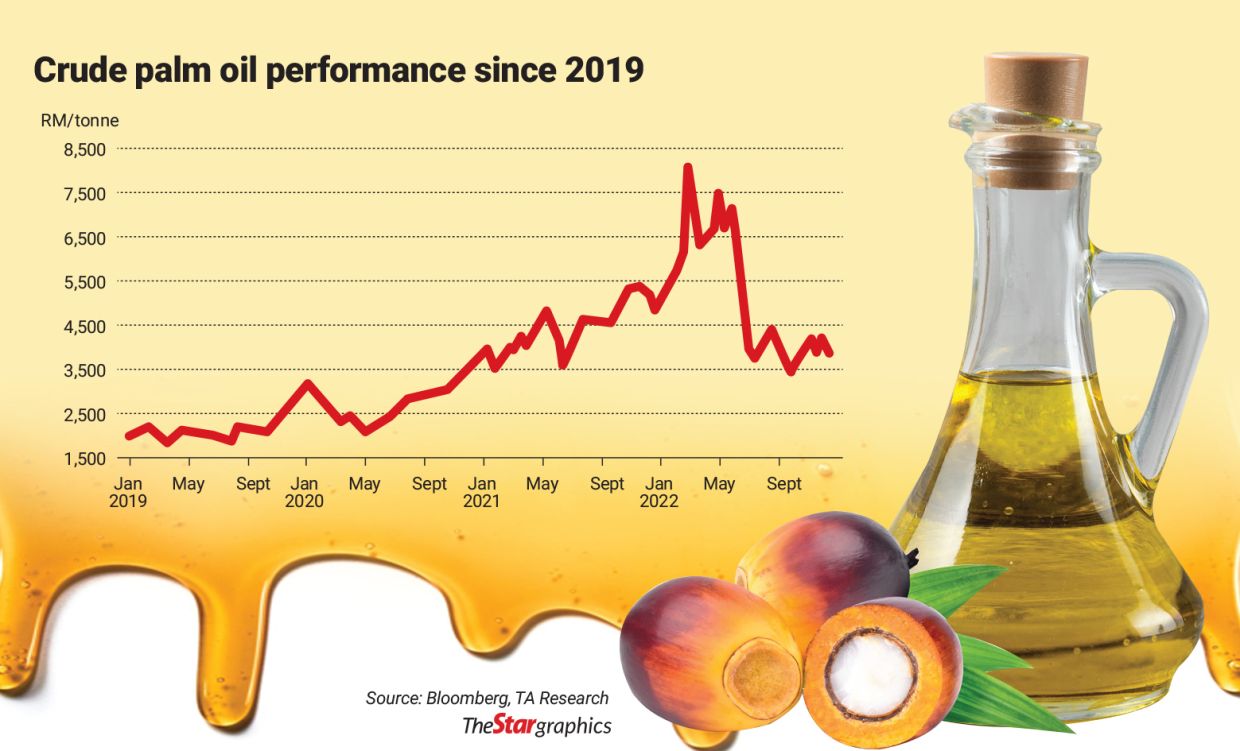

PETALING JAYA: Crude palm oil (CPO) prices may trend within the RM500 range in the near term as price expectations are finely balance by competing bearish and bullish factors, according to traders and analysts.

Over the longer term, the global economic slowdown, improvement in production with the return of foreign workers to the estates and rising costs could drag the average price of CPO to the RM3,500 to RM3,900 per tonne range for 2023 compared with an estimated average CPO of RM4,800 to RM5,200 per tonne for 2022, said plantation analysts.Given such weak fundamentals, most analysts in their latest reports are revising downwards CPO price projections for next year with a “neutral” call on the sector.

Traders on the local derivative exchange, however, said the market price action is signalling at a price floor of around RM3,600 a tonne level supported by the still substantial soyoil CPO spread of US$500 (RM2,212) a tonne compared with US$800 (RM3,538) last month and fresh demand from buyer like India which appeared to be short on rapeseed oil as Black Sea supplies remain constrained.

“The CPO futures contract price is well supported at RM3,600 levels with fresh buying while prices on the top side of RM4,100 to RM4,200 is attracting sellers. Traders are buying on dips with recent bullish data on exports, production and stock levels for the first 10 days of December beating expectations,” said a futures broker representative.

The bottleneck issue with edible oil supplies out of Ukraine has led India to increase its intake of CPO this month despite the strong ringgit/US dollar exchange rate and the monsoon season impacting local production.

Malaysian Palm Oil Association CEO Joseph Tek Choon Yee, however, said Indian demand might not last.

“The palm oil-bean oil (Pobo) spread has narrowed as soyoil weakened after US Environmental Protection Agency announced the biofuel blending target for 2023 lower than market expectation. However, the Pobo is still good at US$500 (RM2,196) per tonne and is still a favourable discount for palm oil.

However, when taking into consideration of the taxes and shipping costs, the import margin for palm oil is unfavourable in India for now.

“Given that India is well stocked, there may be a slowdown in terms of demand. While for China, the import margin for palm oil is relatively good, despite its high stocks. China can be expected to continue its importation,” he said.

CGS-CIMB Research expects 2023 to be a challenging year for most planters due to the falling CPO prices.

While palm oil prices will stay firm at RM3,800 to RM5,000 per tonne at the start of first quarter of 2023 (1Q23), its analysts Ivy Ng and Nagulan Ravi said: “We believe CPO prices could soften from 2Q23 as CPO supply recovers with the entry of more foreign workers while slower global growth could curb demand.”

Hence, CGS-CIMB Research projected the average CPO price at RM5,122 per tonne for 2022 and RM3,800 per tonne for 2023.

On the other hand, the gradual return of foreign workers to help lift the fresh fruit bunch (FFB) yields would partially offset the impact of lower CPO prices and rising costs in terms of minimum wage, potential rise in foreign worker levy, and higher fertiliser costs in 2023.

Tek, however, did not expect the resulting additional tonnages to be excessive.

“The FFB yield-recovery is a given after two years of stress but I do not expect it to be significant due to the lack or incomplete fertilisation, lack of maintenance and rehabilitation works, impact from La Nina as well as the slow return of foreign workers,” he said.

Nixon Wong of Tradeview Capital added new CPO planting had been muted in the past two years due to lockdowns, and hence FFB yields might not be high in the coming year.

China’s reopening and the increase usage by Indonesia on its biodiesel programme may help increase the demand for CPO.

“I believe the downward revision is merely adjusting previously aggressive assumption on CPO prices that took into account extreme factors like supply disruption caused by the Russia-Ukraine war and drought in Latin America. The main focus should be CPO inventory levels instead,” he said.

CGS-CIMB’s anticipation of lower-than-expected local palm oil stockpiles at 1.98 million tonnes for the year-end is positive for CPO prices in the short-term.

As such, the research house has kept a “neutral” rating with its top picks being Kuala Lumpur Kepong Bhd , Hap Seng Plantations Holdings Bhd and Ta Ann Holdings Bhd

, Hap Seng Plantations Holdings Bhd and Ta Ann Holdings Bhd as “value play”.

as “value play”.

Meanwhile, RHB Research noted that CPO prices seemed to be range bound within the RM3,500 to RM4,500 per tonne level.

“With year-to-date price at RM5,218 per tonne, we expect the CPO average price for 2022 to come in close to our RM5,100 assumption,” it added.

Going forward, the research firm expects CPO prices should remain in a similar price range for 2023 as supply improvements will be relatively balanced with a rise in demand.

“While upside risks for CPO prices have moderated in the past few weeks, there are still supportive factors that should keep prices relatively stable,” it said.

They include weather uncertainties, especially with the ongoing La Nina, the availability of fertiliser from Russia, which could impact oilseed crop supply, and growing demand due to discounted CPO prices versus soybean oil.

On the negative front, the palm oil and gas oil (Pogo) price spread has reversed and discretionary biodiesel is no longer feasible, while the newly passed deforestation-free supply chain law in the European Union could impact demand, added the research firm.

RHB Research has six “buy”, five “neutral” and three “sell” calls on planters under its coverage. Its top picks are KLK, IOI Corp Bhd and Wilmar International Ltd.

and Wilmar International Ltd.

TA Research, which cited the return of the low-yielding production season that would last until 1Q23, has made no changes to its 2023 average CPO price estimate at RM4,000 per tonne.

It said the latest November palm oil stockpiles at 2.29 million tonnes came in below market expectations, after five consecutive months of increases.

Production also came in below expectations at 1.68 million tonnes in November against consensus estimate of 1.72 million tonnes.

Despite its “neutral” call on the sector, TA Research maintained its “buy” calls on IOI, FGV Holdings Bhd , TSH Resources Bhd

, TSH Resources Bhd and Wilmar.

and Wilmar.

However, it rated a “hold” on KLK and Sime Darby Plantation Bhd while Kim Loong Resources Bhd

while Kim Loong Resources Bhd and United Malacca Bhd

and United Malacca Bhd remained a “sell” due to their stretch valuations.

remained a “sell” due to their stretch valuations.

TA Research noted the key downside risks to the sector, including the higher-than-expected rise in soybean production, which would likely compress prices of other edible oils in the market, weaker-than-expected demand in China and India, delay in global economic recovery, and unfavourable government policies.

Hong Leong Investment Bank Research also noted the possibility of palm oil stockpiles remaining on a downtrend in the near term.

“Stockpiles will likely remain on a downtrend in the next few months, as the seasonally low production cycle has kicked in and CPO’s wide discount against soybean oil at about US$600 (RM2,649) per tonne will continue to lift palm oil exports,” it said.

It maintained CPO price assumptions of RM5,050, RM4,000, RM3,800 per tonne respectively from 2022 to 2024.

“We believe CPO price will sustain at above RM4,000 per tonne possibly until 1Q23, and will trend down from 2Q23, “ it added.