PETALING JAYA: Moderating growth is the theme in 2023 for the manufacturing sector as the spillover effects of weak external demand from 2022 weigh in, according to the Federation of Malaysian Manufacturers (FMM) business conditions survey.

Carried out from Jan 18 to Feb 28, the survey covered the performance of the manufacturing sector for the latter half of last year (2H22) and the outlook for the first six months of 2023 (1H23), drawing responses from 745 participants.

FMM president Tan Sri Soh Thian Lai said besides slow exports last year, geopolitical tensions and China’s now-terminated zero-Covid policy were also factors that likely had an impact on the Malaysian manufacturing industry.

Despite the downtrend, Soh noted that activity in the sector had held up fairly well, albeit at a slower pace.

This was evidenced by the business activity index which, at 107, had remained above the 100-point optimism marker.

“A total of 37% of respondents said their business activity in 2H22 had remained the same as in 1H22, while 35% reported an increase in theirs and 28% stated otherwise,” he said.

While overall sales had remained steady for the whole of 2022, the survey found that local sales for the manufacturing sector had outgrown export sales.

This is in line with Bank Negara’s latest data that showed an 11.3% year-on-year growth for local manufacturing sales figures against the lower 6.8% for exports.

“Among those who sold domestically, 27% reported higher sales, while 43% managed to maintain their sales in 2H22,” said Soh.

He said exports also rose 27% for manufacturers in external markets, while 37% maintained their exports during the period.

“Poor sales affected more of those who export than those who sold locally, with 36% and 30% confirming this respectively,” he said.

Interestingly, the survey reported that while manufacturing costs had eased, capital investment had likewise waned, with 23% of manufacturers revealing they had increased capital expenditure compared with 28% in 1H22.

One bright spot to be found within the cautious mood was the increase in the employment index figure to 112 for 2H22, up 12 points from 1H22.

This showed that recruitment had picked up in the sector during the period under review, as Soh said.

“Labour intake rose for 26% of the respondents, up from 22% in 1H22 and 20% in 2H21. Meanwhile, 61% put hiring and retrenchment on hold, 14% reduced their headcount, down from 1H22’s 22%.”

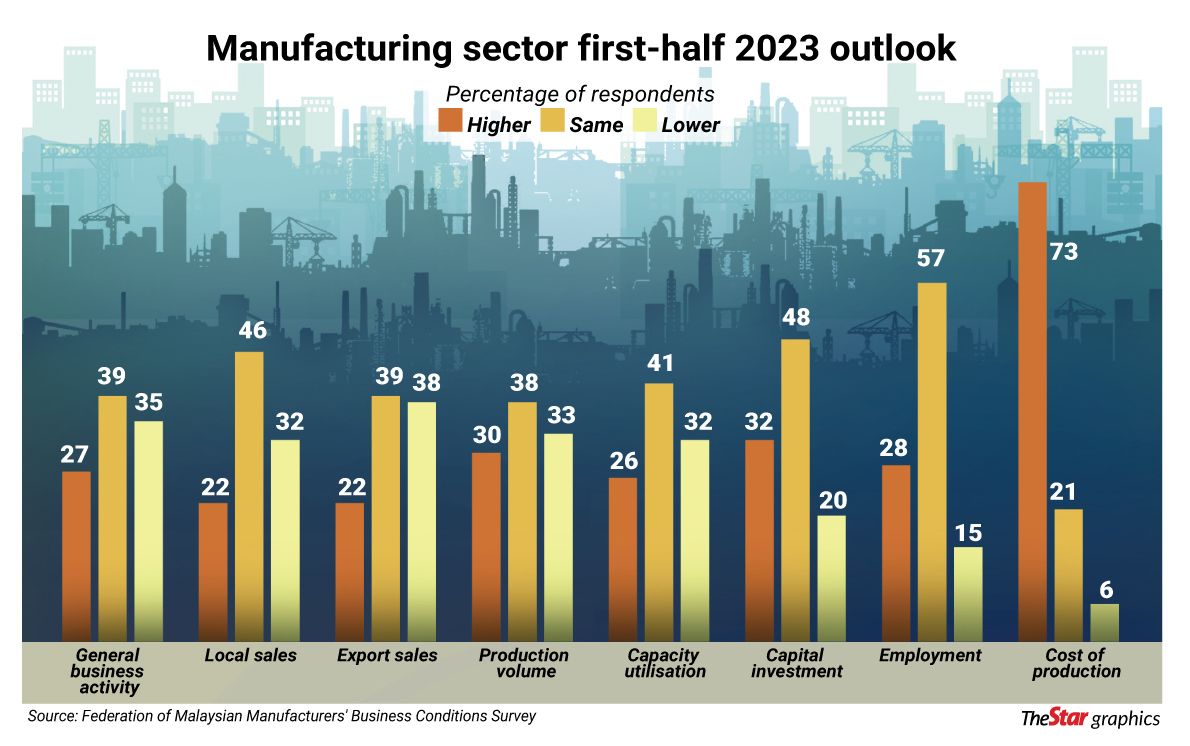

The survey disclosed that forward-looking indicators are suggesting a slowdown in capacity utilisation, capital investment, hiring and a relatively tame outlook on production for 1H23.

Moreover, with the expected index for business activity at 92 points, the present survey is the second consecutive one to score below the optimism threshold, dropping from 94 of the previous study.

This implies that manufacturers anticipate a further slackening in business activity for 1H23, as only 27% of the respondents projected a pick-up in business activity soon, down from 29% previously.

Soh said industry players continue to see domestic sales outperforming export sales from January to June this year, with the expected index for both parameters scoring at 91 and 84 respectively.

Since both figures are way short of the optimism marker, he said this showed that a drag in overall sales figures could be imminent in the coming months.