Khazanah managing director Datuk Amirul Feisal Wan Zahir

PETALING JAYA: Khazanah Nasional Bhd says the higher inflation and interest rate environment as well as volatile global markets presented challenges to its investment portfolio in 2022, which continue to do so into this year.

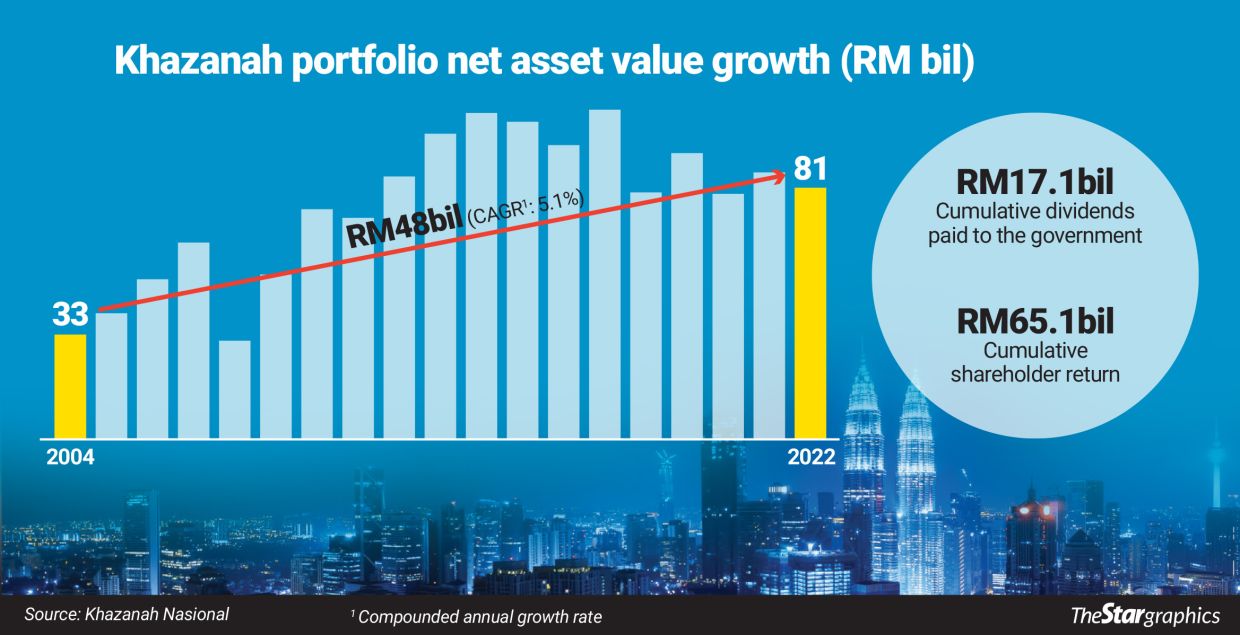

The weaker domestic and global markets in 2022 saw the sovereign wealth fund’s investment portfolio’s net asset value (NAV) fall to RM122.5bil from RM127.1bil in 2021.

Divestment in the private market and lower impairment of its portfolio, however, enabled Khazanah to post a profit of RM1.6bil and pay RM500mil in dividends to the government for the year as compared to a profit of RM670mil profit and dividend of RM2bil in 2021.

The fund paid RM2bil in dividend in due to the exceptional need brought on by the Covid-19 pandemic.

“Despite the challenging market conditions globally, we delivered a satisfactory performance in the first full year of implementing our refreshed strategy.

“Our nation-building mandate of delivering long-term sustainable value remains unchanged and we will ride through the short-term market volatility and remain focused on our long-term goals,” managing director Datuk Amirul Feisal Wan Zahir said at a briefing yesterday.

The year 2022 was when Khazanah implemented its refreshed strategy and approach, anchored on the theme of “Advancing Malaysia”, with the aim of delivering sustainable value.

Amirul, who assumed the managing director’s role in mid-July 2021, said Khazanah is focused on building long-term financial returns and continued its portfolio rebalancing towards the target strategic asset allocation with deployments into public equities, private equities and real assets.

In 2022, RM6.6bil was deployed in new investments and RM2.5bil raised from the monetisation of assets.

Amirul, however, expects 2023 to remain a challenging year for Khazanah’s portfolio as the Malaysian and global markets remain under stress from high inflation and expectations of even higher rates for longer, with some relief offered by China’s reopening following the easing of its zero-Covid policy early this year.

Amirul said the banking failure events in America and the rescue of Credit Suisse Group AG will not have a direct impact on Khazanah’s portfolio as it does not have any exposure to the entities concerned while the indirect impact is expected to be negligible, if any.

He said the fund will take the opportunity to invest in segments presented by the volatility in markets and asset classes geographically from such market events.

At present, two thirds of Khazanah’s portfolio is invested in Malaysia, both in the public and private markets, while some 27% is invested in the same manner globally, primarily in China and the United States, while another 8% is in real assets mainly for yield gains and to act as counter cyclical to its equities exposure.

Khazanah’s new investment approach includes taking an active corporate player role in driving best-in-class performance in its investee companies, crowd-in new private investments, growing its portfolio value globally across various asset classes and help facilitate the flow of knowledge, networks and investment opportunities into Malaysia.

“The fund will stay the course in creating and capturing value, catalysing selected investments and successfully executed value creation plans for its Malaysian assets such as the successful initial public offering of Farm Fresh Bhd on Bursa Malaysia, which was the largest listings in 2022, and the Celcom-Digi merger which would generate scale to deliver innovative products and services and enhance digital connectivity,” he added.

on Bursa Malaysia, which was the largest listings in 2022, and the Celcom-Digi merger which would generate scale to deliver innovative products and services and enhance digital connectivity,” he added.

He said Malaysia Airlines Group’s (MAG) business turnaround plan (till 2025) has yet to complete and the focus now is on improving the “customer experience”, which will include investments in assets such as new planes and information technology infrastructure.

The fund has allocated MAG some RM3.6bil to be utilised for such purposes, of which RM1.3bil has been spent so far, he added.

“Once the carrier is on a more sure footing, we can look at more options including partnerships instead of relisting,” he said. Khazanah took the loss-making national carrier private in 2014.

Khazanah’s portfolio also has RM6bil allocated for investments under its Dana Impak, of which RM500mil will be used to fund its Future Malaysia Programme and Future Malaysia Skills to bolster Malaysia’s startup ecosystem and generate a technically adept talent pool, as well as agrifood projects.

Some of the money will be invested in early-stage companies that require risk capital to scale innovation and their business, Amirul said.

Examples from its such investments include Fram Fresh and Carsome, which was linked to a listing via a special-purpose acquisition company on Nasdaq last year.

The fund’s debt increased marginally to RM49.1bil in 2022 from RM48.5bil in 2021, while its realisable asset value over debt ratio was at 2.7 times, and on track to achieve the long-term target of three times to four times.

The fund recorded a 2.2% four-year rolling net asset value (NAV) time weighted rate of return (TWRR) in 2022 versus 5% three-year rolling NAV TWRR in 2021.

Apart from the RM500mil dividend, Khazanah also paid RM133mil in tax and RM166mil in contribution to government requests and social initiatives in 2022.

Amirul said the fund has no plans to raise fresh cash for its investment purposes and it is fully invested.

Khazanah’s NAV saw a decline of 5% from RM86bil in financial year 2021 (FY21) to RM81bil in FY22, attributed to the global market downtrend.