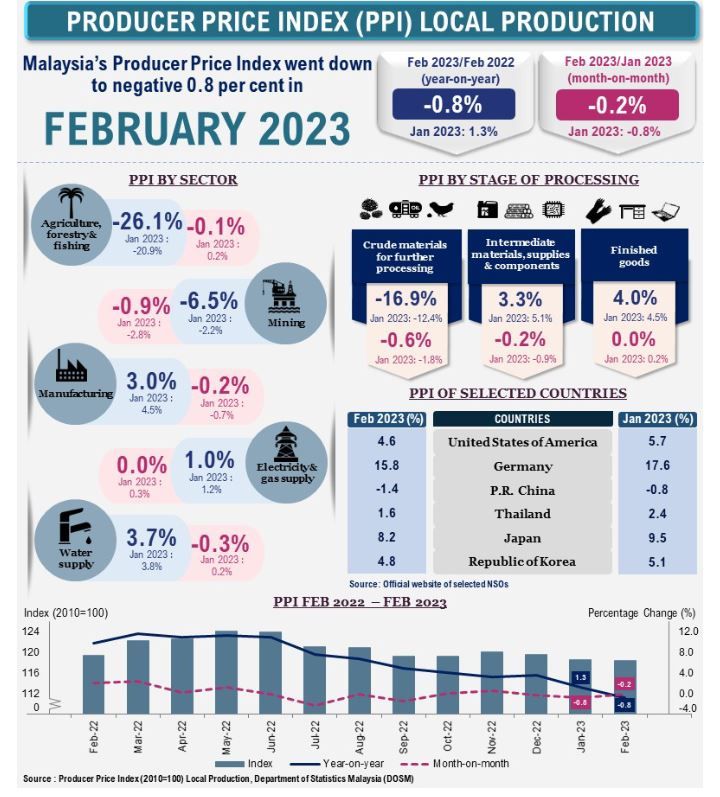

KUALA LUMPUR: The Producer Price Index (PPI) for local production, which measures prices of goods at factory gate, shrank 0.8 per cent year-on-year (y-o-y) in February 2023 against a 1.3 per cent growth in January 2023, the Department of Statistics Malaysia (DoSM) reported today.

Chief statistician Datuk Seri Dr Mohd Uzir Mahidin said the contraction was due to the base effect and lower prices of primary commodities.

He said the downward trend was mainly due to the decline in agriculture, forestry and fishing, and mining sectors.

"The agriculture, forestry and fishing index decreased 26.1 per cent (January 2023: -20.9 per cent) with the fresh fruit bunches price recording a 40.5 per cent decline in February 2023.

"At the same time, the mining index slipped 6.5 per cent (January 2023: -2.2 per cent) mainly due to a 16.1 per cent drop in the extraction of crude petroleum index,” he said in a monthly report today.

Meanwhile, Mohd Uzir said the manufacturing index grew three per cent in February 2023 versus 4.5 per cent growth in the previous month, attributable to the rise of the manufacture of computer, electronic and optical products index (8.5 per cent).

He said that for the utility sector, the water supply index rose 3.7 per cent and the electricity and gas supply index inched up one per cent.

"On a monthly basis, the PPI for local production decreased 0.2 per cent in February 2023 compared to a 0.8 per cent contraction in the previous month,” he said.

Commenting on the PPI by stage of processing, Mohd Uzir said the index of crude materials for further processing continued to slide 16.9 per cent in February 2023 (January 2023: -12.4 per cent) due to a 20.3 per cent decline in non-food materials.

On the inflation at the producer level of selected countries, he said most countries displayed modest inflation in February 2023 due to energy prices, fuel and foreign currency exchange factors.

Additionally, he said, international palm oil prices continued to drop due to lingering sluggish global import demand, despite seasonally lower production from major growing regions in Southeast Asia.

"Having said that, as one of the main exporters, Malaysia’s palm oil price further sank due to low demand and lower gas oil prices,” he said. - Bernama