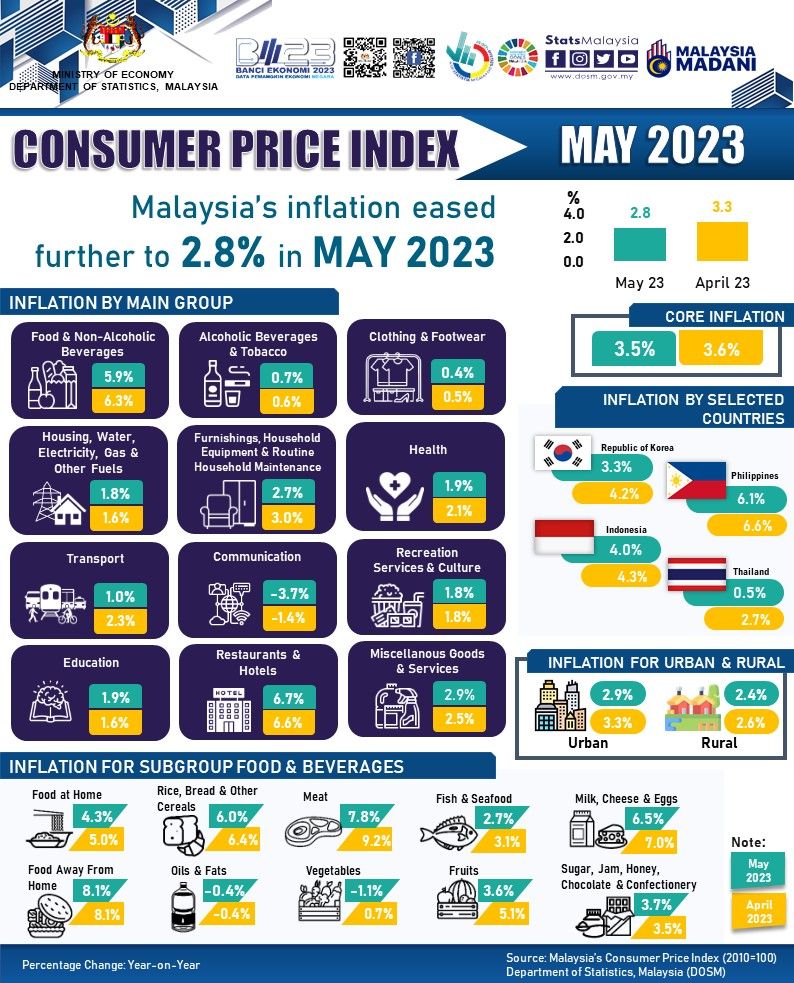

KUALA LUMPUR: Malaysia's consumer price index (CPI) in May rose 2.8% from a year earlier, led higher by an increase in restaurants and hotels prices.

The result was less than forecast by a Reuters poll of economists, who had projected a 3% increase in the index, and below the 3.3% growth recorded in April 2023.

According to the National Statistics Department, the increase in inflation in May was contributed by restaurants and hotels (6.7%) and also by the rise in the prices of miscellaneous goods and services (2.9%), furnishing, household equipment and routine household maintenance group (2.7%), health (1.9%) and education (1.95%).

Housing, water, electricity, gas and other fuels and recreation services and culture recorded an increase of 1.8% respectively.

Nevertheless, the slower increase in some groups as compared to the previous month such as food and non-alcoholic beverages (5.9%), transport (1%) and furnishings, household equipment and routine household maintenance (2.7%) helped to mitigate the increase in inflation.

"Among the factors that contributed to the slower increase was the lower price of unleaded petrol RON97 (May 2023: RM3.35 per litre) as compared to RM4.26 per litre in May last year (April 2023: RM3.35)," said the Statistics Department in a statement.

The monthly headline inflation in May 2023 increased 0.2% as against 0.1% in April 2023.

Core inflation, which measures changes in the prices of all goods and services excluding volatile prices of fresh food as well as administered prices of goods by the government, increased more slowly at 3.5% against 3.6% in the previous month.