Companies Commission of Malaysia (SSM) chief executive officer Datuk Nor Azimah Abdul Aziz said that the experts of SSMN 2023 will share their insights and expertise in tackling 'Anti-Money Laundering/Countering Financing of Terrorism' (AML/CFT).

COUNTERING money laundering and terrorism financing was the focus of the Companies Commission of Malaysia (SSM)’s 12th annual national conference.

With the theme Shared Responsibility in Strengthening Anti-Money Laundering/Countering Financing of Terrorism Compliance: Risks, Challenges and Collaborations, the event aimed to enhance cooperation among regulators, law enforcement agencies and industry players to tackle financial crime.

The SSM National Conference (SSMNC) 2023 was a two-day virtual event on July 25-26, and drew in over 3,000 participants.

SSMNC2023 addressed crucial issues and explored effective strategies to deter illicit activities within the financial system. Besides delving into regulatory expectations, participants assessed the risks associated with money laundering and counter financing of terrorism efforts.

“I hope all the plenary sessions will provide new perspectives and prepare the corporate community to face the challenges in tackling money laundering and countering financing of terrorism,” SSM chairman Ahmad Sabki Yusof said during the launch of the conference on July 25.

He added that the conference has been an established platform over the last decade for regulatory education, earnest discourse, and networking for business and corporate professionals.

Sabki also read out the speech by the late Domestic Trade and Cost of Living Minister Datuk Seri Salahuddin Ayub, who passed away on July 23.

In the speech, Salahuddin said: “The Malaysian government enacted the Anti-Money Laundering Act (AMLA) in 2001 to combat the mounting threat of money laundering. To strengthen the act, it was amended several times and was later known as Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2014.”

The late minister shared that the nation became a member of the Financial Action Task Force (FATF) in 2016 and to date, Malaysia is compliant on 20 FATF recommendations, largely compliant on 18 and partially compliant on two.

“The assessment found that our nation has a robust anti-money laundering and countering financing of terrorism framework with generally well-developed and implemented policies.

“Following FATF’s evaluation, Malaysia worked to develop an action plan for addressing issues identified during the evaluation.”

Also in attendance at the launch were Domestic Trade and Cost of Living Deputy Minister Fuziah Salleh and secretary-general Azman Mohd Yusof.

The chosen topic for SSMNC 2023 aligns perfectly with the overarching objective of promoting financial transparency and thwarting any attempts to misuse the financial system for nefarious purposes.

With experts and stakeholders from various sectors coming together at the conference, significant strides were made in the battle against financial crime and terrorist funding.

SSM chief executive officer Datuk Nor Azimah Abdul Aziz said SSM has issued a guideline called the Reporting Framework For Beneficial Ownership Of Legal Persons Pursuant to Section 20C of the Companies Commission of Malaysia Act 2001 in preparation for FATF’s upcoming mutual evaluation.

She added that SSM also released a consultative paper on proposed amendments to the Companies Act 2016 and Limited Liability Partnership Act 2012 to strengthen the reporting framework on beneficial ownership.

“As a regulatory body, SSM has always supported the national agenda in the fight against money laundering and financing violence,” she said.

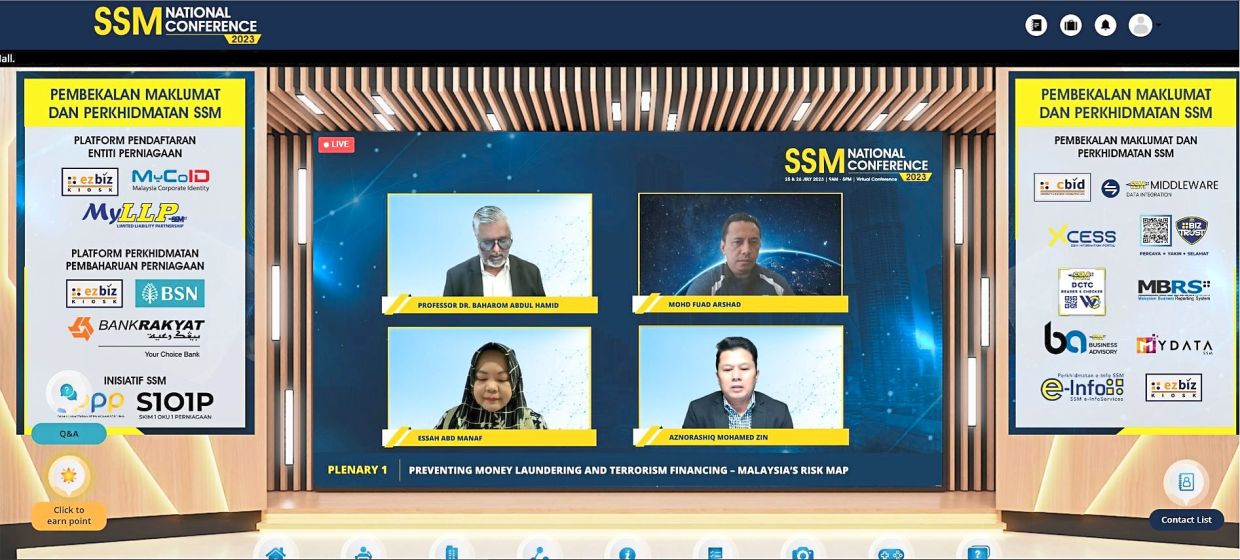

This year, SSMNC2023 hosted 11 plenary sessions with 48 distinguished speakers who explored topics close to the selected theme, and highlighted topics like Preventing Money Laundering and Terrorism Financing – Malaysia’s Risk Map which discussed key findings and recommendations of the National Risk Assessment 2020 (NRA 2020) and FATF Mutual evaluation of Malaysia in 2024-2025.

Notable topics included Be Scam Aware; Prevention and Good Practice in NPO Sector Against Money Laundering; and, Terrorism Financing and Enhancement to the Corporate Rehabilitation Framework.