PETALING JAYA: Forbes Asia has named nine Malaysian companies as part of its Best Under A Billion 2023 list.

The list highlights 200 Asia-Pacific public companies with revenues under US$1bil that have displayed consistent growth in both their top and bottom lines.

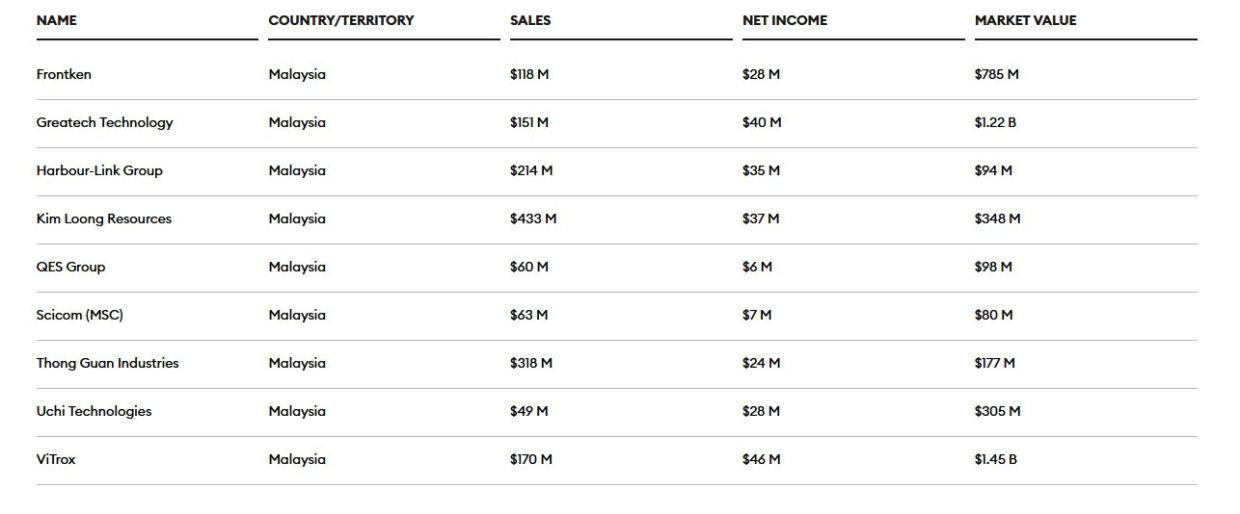

The companies are Frontken Corp Bhd, Greatech Technology Bhd, Harbour-Link Group Bhd, Kim Loong Resources Corp Bhd, QES Group Bhd, Scicom (MSC) Bhd, Thong Guan Industries Bhd, Uchi Technologies Bhd, and ViTrox Corp Bhd.

In a statement, Forbes Asia said companies on this year’s list outperformed despite stiff global headwinds like inflation and rising funding costs.

“The standouts are concentrated in chipmaking and related industries. Demand for semiconductors, found in everyday items like smartphones, appliances and cars, skyrocketed in the past three years with the accelerating adoption of AI technologies although the market is expected to soften somewhat this year as supply constraints ease,” it said.

Other top performers on the list include companies delivering IT solutions that underpin the digital transformation of healthcare, logistics and manufacturing and other industries.

Meanwhile, businesses that rely on consumer spending, such as restaurants, entertainment and sports, continued to see an uptick in sales as Covid-19 restrictions faded away.

“This year's Best Under A Billion list highlights some of the Asia-Pacific region’s best managed small and midsized listed companies, including how they are using AI and digital technologies to improve their competitive edge,” Forbes Asia editor Justin Doebele said.