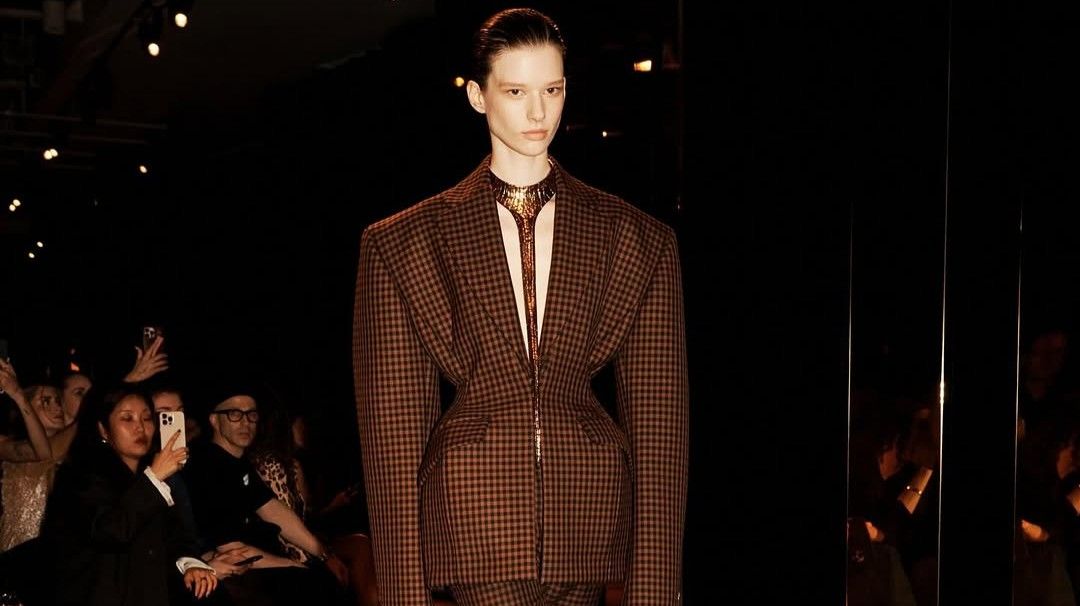

By 2026, Millennials and Gen Zs are expected to account for 75% of luxury goods shoppers. Photo: AFP

By 2026, Millennials and Gen Zs are expected to account for 75% of luxury goods shoppers. This striking evolution is reshaping the luxury landscape, driven by younger, higher-spending, more demanding consumers.

It also brings new trends to the forefront, such as the resale and rental of luxury goods.

According to the True-Luxury Global Consumer Insight 2023 report from BCG and The Altagamma Foundation, Millennials and Gen Zs are playing an increasingly important role in the luxury goods industry.

The report is based on a sample of 12,000 people from the world's 12 major luxury markets (US, UK, Italy, France, Germany, Brazil, China, Japan, South Korea, India, United Arab Emirates and Saudi Arabia).

The consumers selected spend an average of €39,000 (approximately RM193,000) a year on luxury goods (clothing, accessories, jewelry, watches, perfumes, cosmetics, hotels, restaurants, wines, spirits).

By 2022, they already accounted for almost €200bil (RM991bil) of the market, double the 2016 figure, and this is forecast to almost double again by 2026.

What's more, younger generations spend 15% more than other age groups, making a significant contribution to the sector's growth.

Read more: 'Year of the Chinese consumer': Luxury fashion brands pin growth hope on China

The rise of resale and rental

Millennials and Gen Zs are also driving another emerging trend in the luxury market: the resale and rental of luxury goods.

In 2022, a third of consumers surveyed had bought second-hand luxury goods, an increase of seven points on 2020, and 22% opted to rent luxury goods, an increase of four points in two years.

Both trends are particularly strong among younger consumers, with 35% of Millennials and Gen Zs having purchased second-hand luxury goods and 26% having rented luxury goods over the past year.

Discerning consumers in search of personalized experiences

Despite their growing appetite for luxury goods, younger shoppers can be picky when it comes to the customer experience.

Although luxury brands have made considerable efforts to improve the in-store shopping experience, less than 50% of consumers surveyed said they were truly satisfied with their experience, and 11% even said they were underwhelmed.

According to the report, few luxury brands have succeeded in recreating online the emotional factors experienced during an in-store purchase.

This "digital disconnect" is particularly noticeable among Gen Zs and in Europe, where one in five young people consider their online shopping experience disappointing, compared with one in ten baby-boomers.

These new demands are prompting luxury brands to rethink their approach to attracting and retaining young consumers.

Read more: Style-conscious Gen Zs travel to Seoul for 'personal colour analysis' service

According to Joel Hazan, managing director at BCG and luxury sector expert, cutting-edge technologies such as generative AI and Web3 can enable brands to offer ultra-personalised, immersive customer experiences.

These tools can play a crucial role in meeting the expectations of a diverse, digital-native audience.

This approach has borne fruit in China, where technologies in this field are more advanced. In fact, only 13% of luxury buyers report being underwhelmed by their online purchasing experience, while around half (46%) of domestic purchases are made online.

The international luxury goods market is showing solid growth worldwide. It is expected to be worth some €1,300 billion by 2026, with an annual growth rate of 6% between 2022 and 2026. – AFP Relaxnews