KUALA LUMPUR: MPs have continued demanding answers over the FashionValet controversy despite former Damansara MP Tony Pua arguing that profits and losses were part and parcel of venture capital investments.

Petaling Jaya MP Lee Chean Chung said it was important for Khazanah Nasional Bhd to explain its reasons for investing in FashionValet and why it did not back out earlier.

“If investing in a basket of high-risk tech companies is bound to have losers, then show us who are the winners,” said Lee in a posting on X on Nov 5 (Wednesday).

Lee was echoing a remark made by Bandar Kuching MP Kelvin Yii, who said there were red flags in FashionValet from the outset, such as a lack of accountability and monitoring despite years of losses.

“There were no Khazanah or Permodalan Nasional Bhd (PNB) personnel on board to monitor or advise, which may have managed losses in the beginning and added value to the company,” said Yii on X on Nov 5.

Yii said huge sums of funds cannot be managed without oversight under the guise of “high-risk venture capital investment”.

“Although, Pua’s arguments are not without merits. I think we need to take out the ‘emotions’ on this matter and the investigations should be on governance and accountability.

“It cannot be a witch hunt which may stifle future venture capital ecosystems,” said Yii.

In a Facebook posting on Monday (Nov 4), Pua said criticisms against FashionValet have been “misguided and unfair”, as it focused mainly on the percentage of losses while ignoring the broader context of venture capital.

Pua said the venture capital landscape is inherently risky, with more failures than successes.

“The venture capital game is to expect that out of 10 investments, three or four will be disasters, another three or four will be about covering costs and another two or three will make spectacular returns.

“If we want to be in this game of creating regional or even global unicorns, then we must be prepared to incur ‘disasters’,” said Pua.

Umno Youth chief Datuk Dr Muhamad Akmal Saleh said that while profits and losses are normal in business, it is extraordinary that large amounts of public funds would be poured into a company that has allegedly posted losses for five consecutive years.

“It is even more extraordinary when someone tries to defend it,” said Dr Akmal.

Dr Akmal also pointed out the contrast whereby a normal Malaysian will find it difficult to borrow even RM10,000 for their own business.

“It is okay, stupidity is free and continue that stupidity,” said Dr Akmal, without naming names.

In a written Parliamentary reply last week, the Finance Ministry stated that Khazanah and PNB sold their shares in the e-commerce platform for RM3.1mil to NXBT Partners last year.

This contrasts with the RM47mil investment made by Khazanah and PNB in 2018, comprising RM27mil and RM20mil respectively for minority stakes in FashionValet.

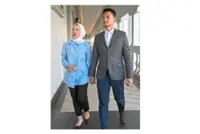

FashionValet founders Datin Vivy Yusof and Fadzaruddin Shah Anuar have apologised for the losses and announced they would step down from their positions as chief executive officer and executive director, respectively.

Vivy and Fadzaruddin are currently being questioned by the Malaysian Anti-Corruption Commission (MACC) over the investment losses linked to Khazanah and PNB.