Concrete policies, instead of ‘abstract vocal support’ from China’s leadership, are needed by Big Tech firms to grow, analysts say. The Central Economic Work Conference’s show of support comes months after the State Council pledged policies to help the country’s digital economy. — SCMP

China’s Big Tech companies are expected to receive much-needed policy relief to help bolster the country’s economic recovery efforts, according to analysts, after Beijing last week pledged its strongest support for the sector’s growth.

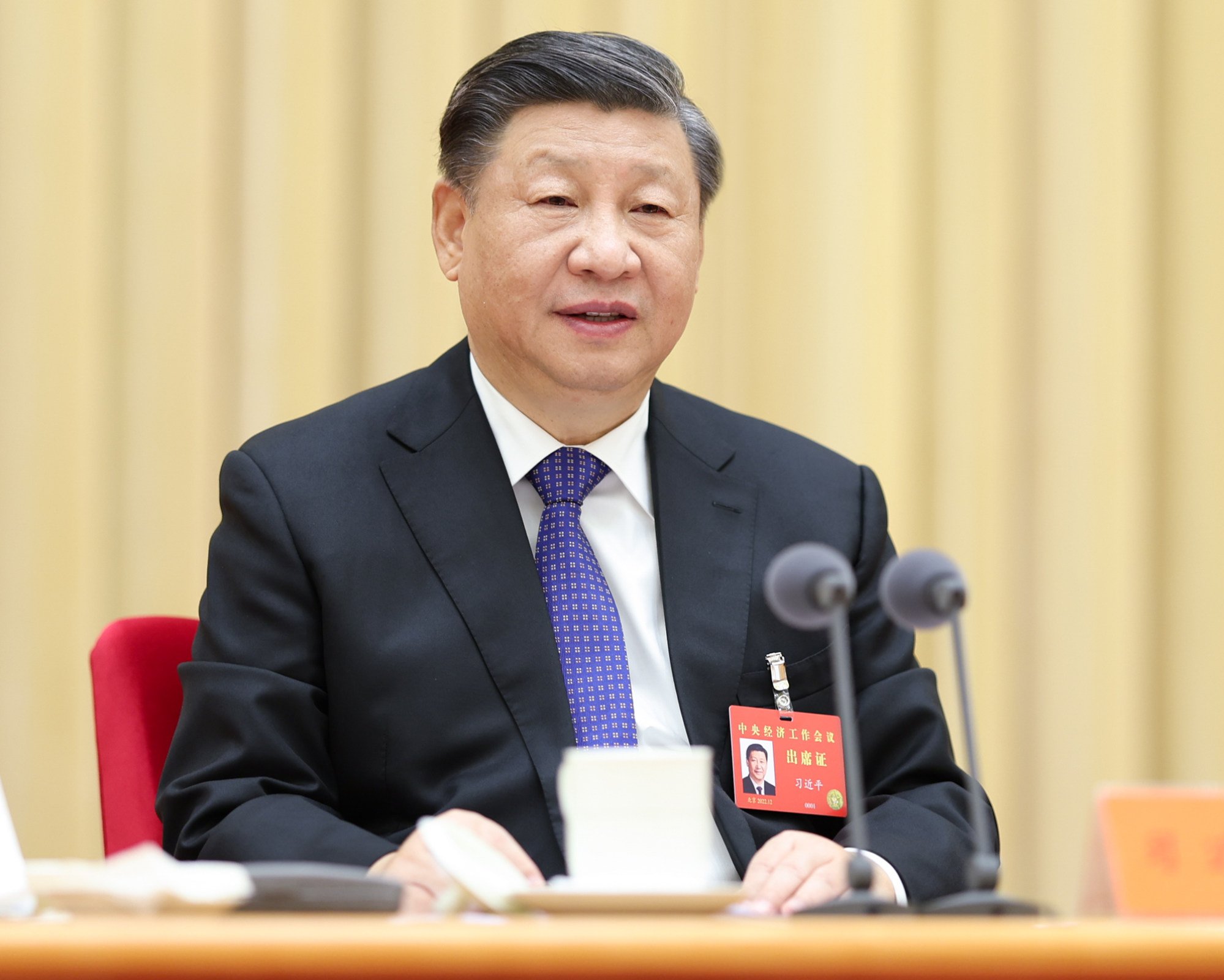

This positive development emerged at the conclusion on Friday of the two-day Central Economic Work Conference (CEWC) in Beijing, where the government leadership headed by President Xi Jinping said China’s “platform enterprises” – referring to large Internet services operators like Alibaba Group Holding and Tencent Holdings – will be supported to “fully display their capabilities” in bolstering economic growth, job creation and international competition. Alibaba owns the South China Morning Post.

The closed-door meeting, convened annually by the Central Committee of the Chinese Communist Party, sets the tone for the roll-out of new policy guidelines in the world’s second-largest economy.

“I expect these platform technology companies to get some breathing room for growth,” said Iris Pang, chief economist for Great China at Dutch banking group ING.

The show of support comes months after the State Council, China’s cabinet, vowed to strengthen the country’s digital economy through major new policy commitments, signalling Beijing’s response to the Biden administration’s recent moves imposing further US restrictions against the mainland’s tech industry.

Analysts, however, indicated that more concrete action is needed by China’s Big Tech firms because of mixed signals from Beijing, following a series of crackdowns that have disrupted the industry and wiped out tens of billions of dollars from the value of many companies.

In November, an official from the Cyberspace Administration of China said at a press conference that Beijing will continue with the concept of “development and regulation in parallel”, or carrot-and-stick approach, in its dealings with internet platform operators.

While the positive messages from this year’s Central Economic Work Conference “are as encouraging as those from the CEWC a year ago ... markets may not take these statements at face value after the economy was hammered by zero-Covid (policy) and some of the sectors dominated by private ownership, such as off-campus tutoring and real estate, were inhibited by regulations”, according to a report by researchers at Japanese financial services firm Nomura.

Nomura’s view is shared by Beijing-based ecommerce consultancy Dolphin’s founder and chief analyst Li Chengdong, who said “vocal support is just too abstract” because the industry needs to see concrete policies rolled out in support of Big Tech companies’ growth.

“(Growth of platform enterprises) depends on demand, without which expansion and innovation will be difficult,” Li said.

Beijing’s zero-Covid-19 policy has hammered consumption across the country, leaving local governments’ finances stretched thin by the burden of maintaining the hardline coronavirus controls.

In response, China’s leadership said at the CEWC that the country’s coronavirus response has entered a new phase, with the focus now on treatment and prevention.

In a 22,000-character strategic report, jointly published last week by the central leadership of the Chinese Communist Party and the State Council, the government unveiled a grand plan to expand domestic consumer demand for the next 13 years.

The plan involves pushing forward the development of online entertainment and healthcare, as well as support for autonomous driving and autonomous delivery services. Support will also be provided to live-streaming ecommerce and the sharing economy, encompassing transport, accommodation and travel.

China’s top-tier Internet companies are forecast to see strong revenue growth as part of the post-Covid-19 consumption recovery, according to analysts at Kaiyan Securities in Xian, capital of northwest Shaanxi province. These include those firms involved in video gaming, online advertising, ecommerce and on-demand local services.

Food delivery giant Meituan, for example, is expected to benefit from the shift in government policy, according to analysts from Soochow Securities.

Once the Internet platform companies create more jobs and drive stable salary growth, the government should give them opportunities to grow in new areas, ING’s Pang said. – South China Morning Post