Total computing power in China accounted for 26% of the world’s total as of June, trailing only the US, but CPU usage rates are low. — SCMP

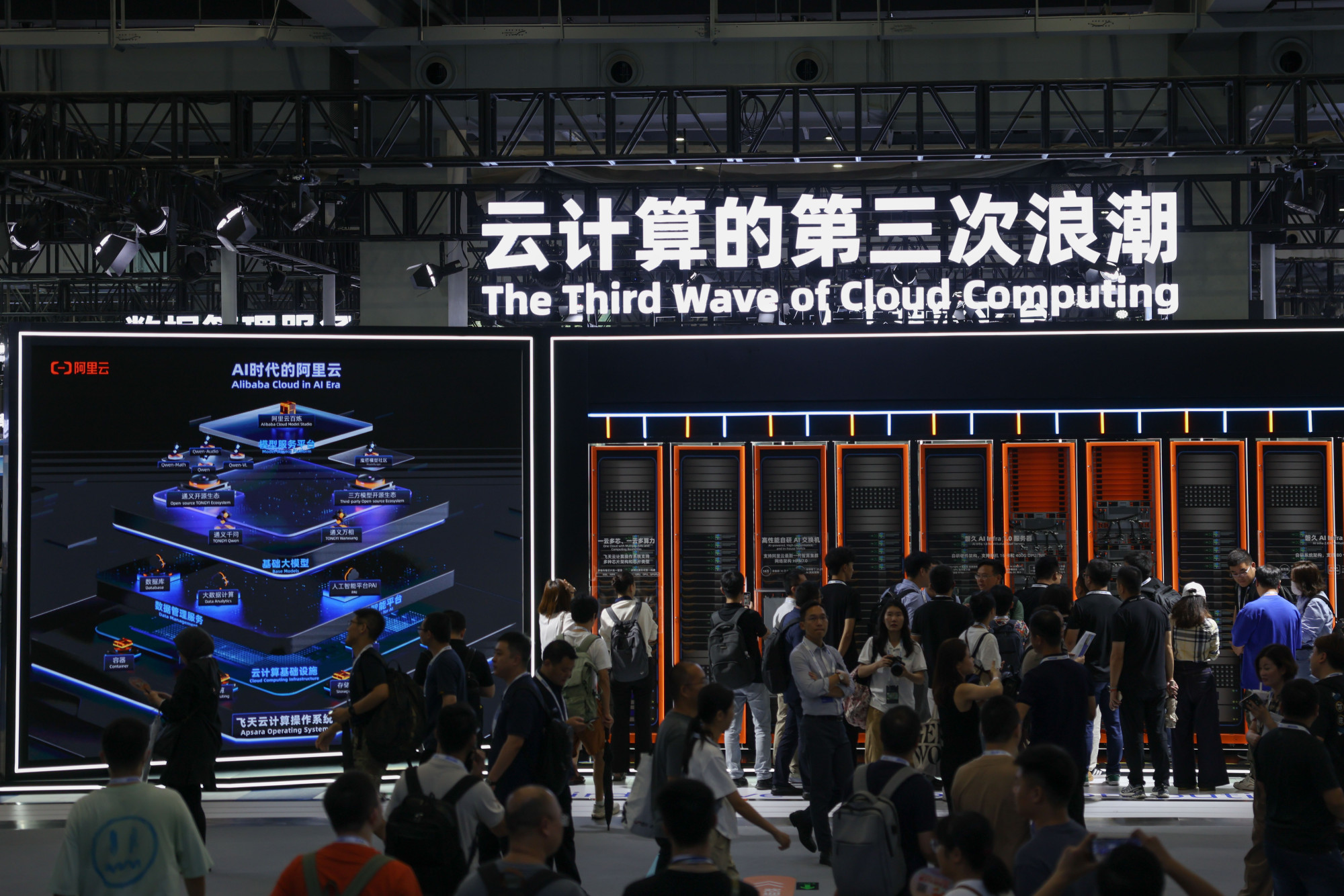

China’s rush to build a nationwide network of artificial intelligence (AI) data centres is running the risk of creating an oversupply of computing power, experts and industry professionals said.

Data from CCID Consulting, a government-backed think tank focused on technology, shows that more than 250 internet data centres have either been built or are under construction in China as of June, as local governments, state-owned telecommunications network operators and private investors pour money into the “new infrastructure”.

Many of these artificial intelligence (AI) computing facilities are also located in areas far from the nation’s technology centres.

Total computing power in China reached a whopping 246 Eflops as of June this year, according to data published in September by the China Academy of Information and Communications Technology (CAICT), an institute affiliated with the Ministry of Industry and Information Technology. Eflops is a unit for measuring the speed of a computer system.

That accounted for 26% of the world’s total, trailing only behind the US, according to CAICT.

However, the central processing unit (CPU) use rate of computing resources provided by privately-held servers is less than 5%, according to a research report on the public cloud issued by China’s State Information Centre (SIC), a group affiliated with the National Development and Reform Commission. Experts warn of an impending glut of computing power as many data centres sit idle due to lack of demand.

“In the past few years, with the buildout of new infrastructure, some government-backed companies did build some data centres which now sit idle,” said Helen Fang, head of industrial research at HSBC. “These centres tend to not be located in or around first-tier cities, or are too small in size to meet mainstream demand.”

China’s provincial governments are rushing to support new data centres to spur the local economy, according to an employee of a mainland AI chip start-up, who declined to be named. There is little consideration given to how the data centre could operate after it is built, the person added.

Shan Zhiguang, a director at the State Information Centre, warned in April that many jurisdictions in the country are rushing to build data centres, based on the suppliers’ sales agenda instead of market demand. “The demand for computing power in China is still limited due to the lack of big models-based killer applications,” Shan said. “If built too early and too much, it may create a glut,” he told Chinese media 21st Century Business Herald.

Amid US sanctions that restrict Chinese enterprises from buying advanced chips from suppliers like Nvidia, many of these government-backed projects were given tacit orders to prioritise the use of domestic CPUs, graphics processing units (GPUs) and memory chips over foreign counterparts. That would only aggravate the situation because domestic-made hardware from various brands is more difficult to configure, especially if connected to form large computing clusters consisting more than 10,000 GPUs, according to experts.

In one example, China Mobile’s newest data centre is in Harbin, capital of northeast Heilongjiang province, and runs on 18,000 domestic-made GPUs. Separately, Jixi, a traditional coal-mining city in the province, inked a deal in May with a Hainan construction company to invest 14bil yuan (RM8.48bil or US$1.98bil) to build a data centre using only Chinese suppliers, including Tencent Cloud, AI chip start-up EnFlame, and Chinese chip giant Sugon.

Government-built data centres are often required to use domestic hardware and software together, according to a former manager of SenseTime who works on generative AI-related projects. Domestic GPUs are only compatible with certain models, this person said. So if a company wants to train or use foreign models it has to use Nvidia cards, not government-owned computing resources, the person added. – South China Morning Post